What is the adoption tax credit?

The tax code provides an adoption credit of up to $15,950 for qualified adoption expenses in 2023. The credit is available for each child adopted, whether via public foster care, domestic private adoption, or international adoption. The total amount of adoption credits for tax year 2020 was around $322 million.

Credit Amount

Taxpayers can receive a tax credit for all qualifying adoption expenses up to $15,950 in 2023. The maximum credit is indexed for inflation. Taxpayers may also exclude from income qualified adoption expenses paid or reimbursed by an employer, up to the same limit as the credit. Taxpayers can use the tax credit and the income exclusion but cannot claim the same expenses for both.

“Special needs” adoptions automatically qualify for the maximum credit regardless of actual out-of-pocket expenses. For purposes of the credit, a child has special needs if a state’s welfare agency determines that the child cannot or should not be returned to his or her parents’ home and that the child probably will not be adoptable without assistance provided to the adoptive family. This provision is designed to encourage parents to adopt children who would otherwise be hard to place, even if most of the adoption expenses are covered by someone else (such as a public foster care program).

Eligibility

The adoption credit is available to most adoptive parents, with some exceptions. The credit is not available to taxpayers whose income exceeds certain thresholds. The thresholds are indexed for inflation. In 2023 the credit begins to phase out at $239,230 of modified adjusted gross income and phases out entirely at income of $279,320. The credit also is not available for adoptions of stepchildren.

Refundability

The adoption tax credit is nonrefundable but can be carried forward for up to five years. The credit is thus of little or no value to low-income families who pay little or no income tax over a period of years. The Patient Protection and Affordable Care Act of 2010 made the adoption tax credit refundable for 2010 and 2011. Concerned about the potential for fraud, the Internal Revenue Service (IRS) stepped up compliance efforts. The result, according to the National Taxpayer Advocate Service, was substantial delays for taxpayers, with 69 percent of all adoption credit claims filed in 2012 selected for audit. The IRS ultimately disallowed only 1.5 percent of claims, and 20 percent of the savings from the disallowed credits was spent on interest owed to taxpayers with delayed refunds. The credit reverted to becoming nonrefundable in 2012.

Cost of the Credit

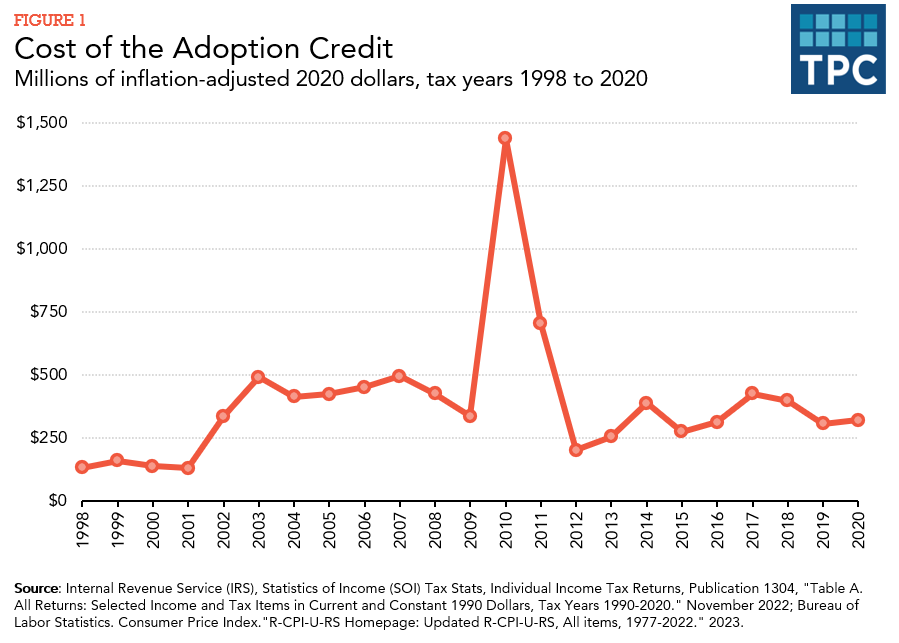

The credit has been repeatedly expanded, from an initial maximum value of $5,000 in 1997 to $14,300 in 2020. In 2020, taxpayers claimed total adoption credits of $322 million (figure 1). The temporary availability of a refundable credit pushed the cost of the credit up to the dramatically higher figures of $1.2 billion in 2010 and $610 million in 2011 (including the refundable portion).

Who Receives the Credit

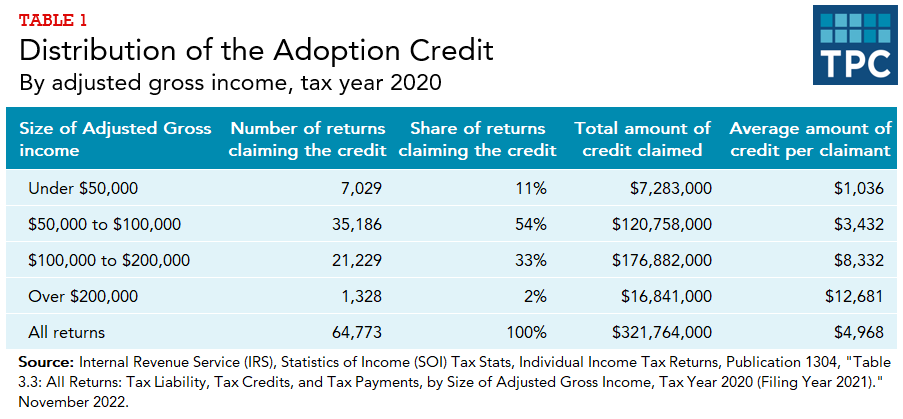

The tax credit largely benefits households with moderate incomes. In tax year 2020, nearly 90 percent of the total number of returns claiming the credit were those with adjusted gross incomes between $50,000 and $200,000. The average credit amount claimed was highest for those with over $200,000 (table 1).

The most recent year with data available by adoption type (2004) indicates that nearly half of adoptions for which the credit was claimed were for domestic children without special needs, with only 18 percent classified as special needs, and the remainder reflecting international adoptions.

Updated January 2024

Geen, Rob. 2007. “The Adoption Tax Credit: Is it an Effective Approach to Promote Foster Care Adoption?.” Washington, DC: Child Trends.

IRS, Statistics of Income Division. SOI Tax Stats—Individual Income Tax Returns Publication 1304 (Complete Report Table A. “Selected Income and Tax Items for Selected Years, in Current and Constant 1990 Dollars”; and Table 3.3. “All Returns: Tax Liability, Tax Credits, and Tax Payments.”

Internal Revenue Service (IRS). 2022. “ 26 CFR 601.602: Part III Administrative, Procedural, and Miscellaneous.” IRS Revenue Procedure 2022-38.

US Department of the Treasury. 2023. Tax Expenditures. Washington, DC.

Crandall-Hollick, Margot L. 2020. “Adoption Tax Benefits: An Overview.” CRS Report No. R44745. Washington, DC: Congressional Research Service.

George, J. Russell. 2011. “Improper Payments in the Administration of Refundable Tax Credits.” Testimony before the Subcommittee on Oversight, House Committee on Ways and Means, Washington, DC, May 25.

Internal Revenue Service. 2018. “Topic 607: Adoption Credit and Adoption Assistance Programs.” March 1., Washington, DC.

National Taxpayer Advocate Service. 2012. “Most Serious Problems #7: The IRS’s Compliance Strategy for the Expanded Adoption Credit Has Significantly and Unnecessarily Harmed Vulnerable Taxpayers, Has Increased Costs for the IRS, and Does Not Bode Well for Future Credit Administration.” In 2012 Annual Report to Congress, volume 1, 111–33. Washington, DC: Taxpayer Advocate Service.

Treasury Inspector General for Tax Administration. 2012. Processes to Address Erroneous Adoption Credits Result in Increased Taxpayer Burden and Credits Allowed to Nonqualifying Individuals. Washington, DC: US Department of the Treasury.