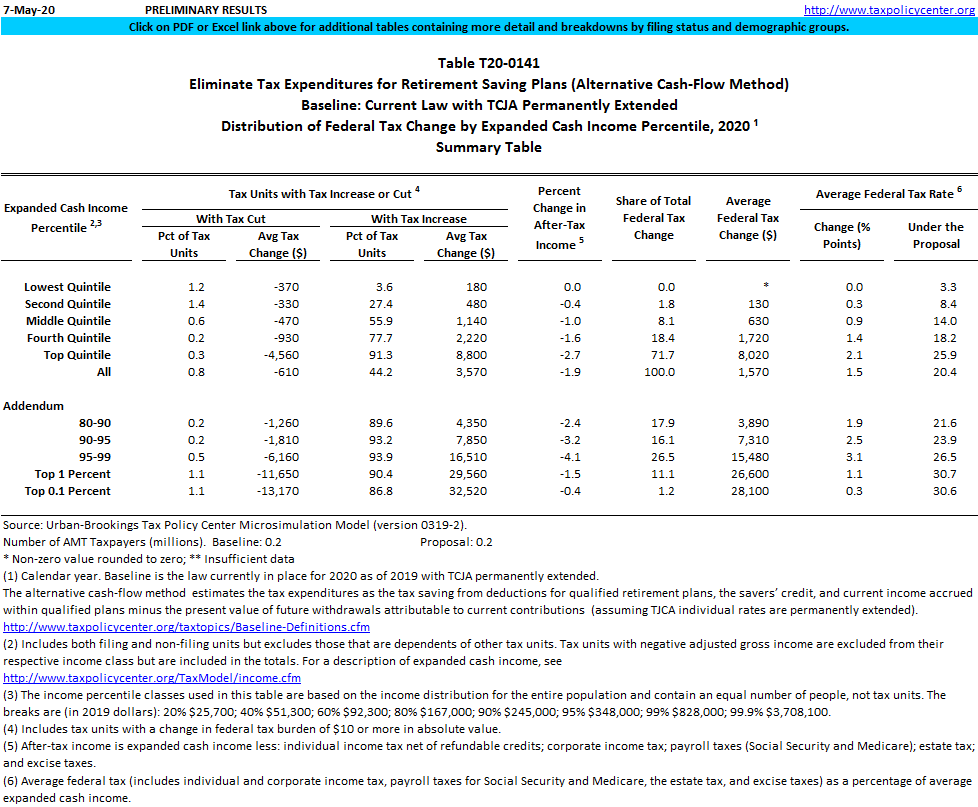

T20-0141 - Eliminate Tax Expenditures for Retirement Saving Plans (Alternative Cash-Flow Method), Baseline: Current Law with TCJA Permanently Extended, Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2020

The alternative cash-flow method estimates the tax expenditures as the tax saving from deductions for qualified retirement plans, the savers’ credit, and current income accrued within qualified plans minus the present value of future withdrawals attributable to current contributions. Baseline is the law in place as of December 18, 2019, with the Tax Cuts and Jobs Act of 2017 (TCJA) permanently extended.