The voices of Tax Policy Center's researchers and staff

Columbia University’s Center on Global Energy Policy just released a series of papers on how a carbon tax would reduce greenhouse gas emissions, affect economic growth, and shift the distribution of tax burdens across income groups. The series includes a new paper by Joseph Rosenberg, Eric Toder, and Chenxi Lu of the Tax Policy Center showing that combining a carbon tax with tax rebates could benefit low-income households.

Consistent with earlier studies by TPC authors, Rosenberg and co-authors found that a carbon tax alone would impose moderately higher burdens as a share of income on lower-income households than on those with higher incomes. However, if the net revenue from the carbon tax were fully returned to households via rebates, the net combined effects could be more progressive.

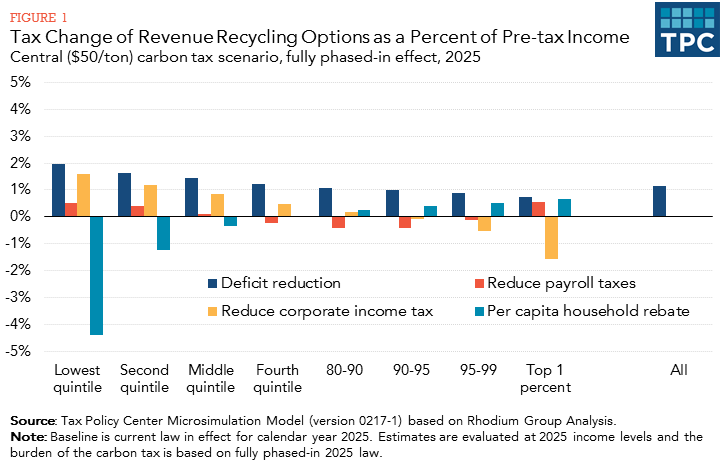

The design of the rebates would be critical (Figure 1). For instance, if carbon tax revenues are used to reduce corporate income taxes, burdens on low-income households would increase while burdens on upper-income households would decrease. If carbon tax revenues funded payroll tax cuts, burdens on households in the bottom 60 percent of the income distribution would on average increase slightly, while average burdens would decrease for other households, except for those in the top 1 percent of the income distribution. If carbon tax revenues financed an equal per-capita rebate to all taxpayers, then lower-income households would pay less as a share of income while upper-income households would pay more.

A carbon tax can be an efficient way to reduce greenhouse gas emissions and slow the harmful effects of climate change. It relies on market forces to drive short-term reductions in fossil fuel use and create medium- to long-term shifts to renewable energy technology. For this reason, it is important for policymakers to understand how such a levy can be combined with measures that provide relief to the low- and middle-income households who can least afford higher energy prices.

While enactment of a national carbon tax is unlikely in the current political environment, prospects may improve once the public becomes more aware of the harm that climate change is producing and more aware that there are ways to address any harmful distributional consequences.

Posts and comments are solely the opinion of the author and not that of the Tax Policy Center, Urban Institute, or Brookings Institution.

Tags

Share this page

Branden Camp, File/AP Photo