Legislative proposals for new approaches to work and child tax credits aim to reduce poverty and income inequality, strengthen the middle class, and support children and low-income workers. This page presents the Tax Policy Center’s analysis of these congressional proposals as well as related reports and blog posts that explore the complexities of work and child tax credits.

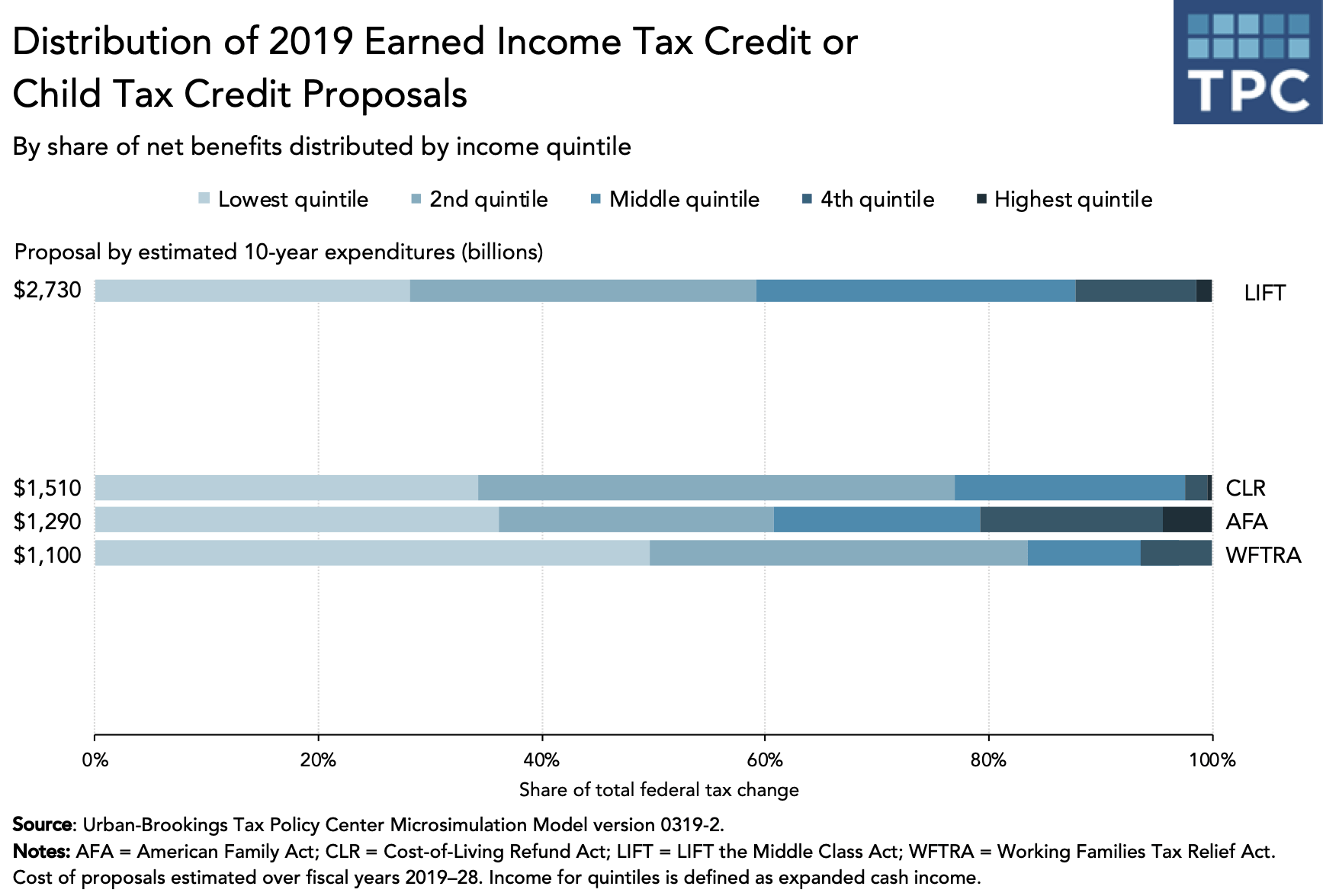

We analyze the cost, distribution of benefits, phase-in and phase-out ranges, maximum benefit, and average increase in tax benefit for the several proposals. Each is a large-scale policy that would be enacted over the 10-year budget window and would substantially increase tax credits for work or children. They are as follows:

- Cost-of-living refund

- LIFT (Livable Incomes for Families Today) the Middle Class Act

- American Family Act

- Working Families Tax Relief Act

Analysis of legislative proposals

- Understanding the Maze of Recent Child and Work Incentive Proposals

- Table: Basic Worker Credit Parameters, current law and various proposals, 2019

- Table: Advanced Payment Options, current law and various proposals, 2019

- Table: Age Limits for Childless Workers, current law and various proposals, 2019

- Table: Child Tax Credit, current law and various proposals, 2019

Additional resources

- Working Families Tax Relief Act Provides Substantial Benefits - And Misses Opportunity

- The Senate Democrats’ Plan To Expand Refundable Tax Credits For Working Families Builds On Existing Ideas

- How To Choose Among Tax Credits That Aim To Support Work, Children, And Poverty Reduction

- Congress Should Make The EITC Available To Older Workers

- Senator Harris Seeks To Raise Incomes Using A New Tax Credit

- Harris’s LIFT Act Would Bring New Benefits to Young Workers and Low-Income Students

- Redesigning the EITC: Issues in Design, Eligibility, Delivery, and Administration

- Revenue and distribution estimates by proposal