The Tax Policy Center regularly produces tables showing the distribution of income and federal taxes, effective and marginal tax rates, and other measures of federal taxes. Other tables show estimates of individual tax expenditures, the share of taxpayers who pay no income or payroll tax, the distribution of capital gains and business income, and aspects of the alternative minimum tax.

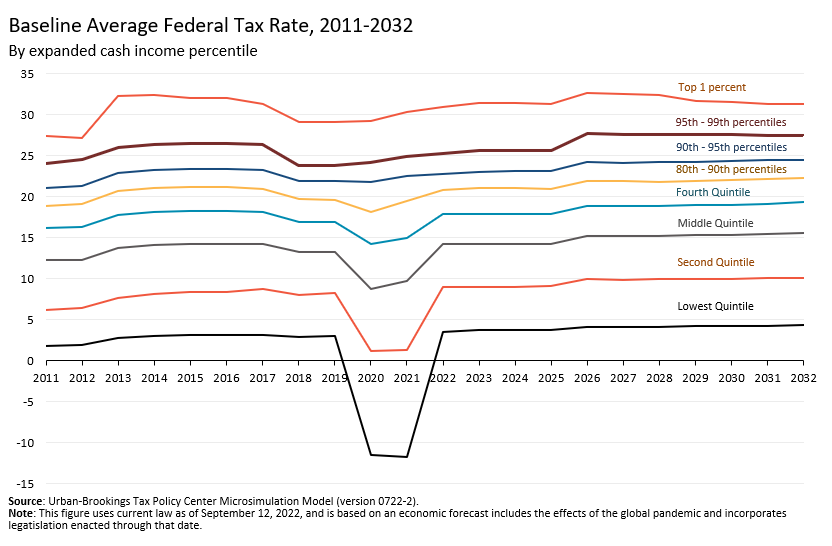

Once most TCJA individual income tax provisions expire at the end of 2025, effective federal tax rates are projected to rise from 19.4 percent to 20.4 percent. The figure below shows that the upper income households who benefited the most from the tax cuts generally experience the largest changes when they are reversed.

Follow the links below to view TPC tables covering those and other tax topics.

Baseline Distribution of Income and Federal Taxes (October 2022)

Baseline Distribution of Tax Units by Tax Bracket (October 2022)

Baseline Average Effective Tax Rates (October 2022)

Baseline Share of Federal Taxes (October 2022)

Baseline Effective Marginal Tax Rates (October 2022)

Distribution of Federal Payroll and Income Taxes (December 2022)

Distribution of Long-Term Capital Gains and Qualified Dividends (January 2023)

| By Expanded Cash Income Level | |||||

| 2022 | |||||

| By Expanded Cash Income Percentile | |||

|

|||

Distribution of Individual Income Tax on Long-Term Capital Gains and Qualified Dividends (January 2023)

Tax Units with Zero or Negative Income Tax (October 2022)

Distribution of Tax Units that Pay No Individual Income Tax (October 2022)

Estate Tax Returns and Liability (November 2022)

Distribution of Estate Tax Returns, Gross Estate, and Net Estate Tax (November 2022)

Baseline Alternative Minimum Tax (AMT) Tables (October 2022)

Aggregate AMT Projections

Aggregate AMT Projections and Recent History

Characteristics of AMT Payers

Distribution of Business Taxes and Sources of Flow-Through Business Income (February 2023)

| Distribution of Business Income in 2022 | |||||||

| By Statutory Marginal Tax Rate | By Expanded Cash Income Level | By Expanded Cash Income Percentile | |||||

| Sources of Flow-Through Business Income in 2022 | |||||||

| By Statutory Marginal Tax Rate | By Expanded Cash Income Level | By Expanded Cash Income Percentile | |||||

Individual Income Tax Expenditures (December 2022)

Partial Exclusion of Social Security Benefits

Exclusion of Employer-Sponsored Health Benefits

Deduction for State and Local Income and Sales Taxes

Deduction for State and Local Taxes

Deduction for Property Taxes

Deduction for Home Mortgage Interest

Deduction for Home Mortgage Interest and Property Taxes

Deduction for Charitable Contributions

Preferential Rate on Capital Gains and Dividends

Preferential Rates and NIIT on Capital Gains and Dividends

Net Investment Income Tax (NIIT)

Child Tax Credit (CTC)

Dependent Care Tax Credit (CDCTC)

Earned Income Tax Credit (EITC)

CTC, CDCTC, and EITC

Education Credits and Deduction for Student Loan Interest

Sec199A Deduction for Qualified Business Income

| By Expanded Cash Income Level | |

| 2022 | |

| By Expanded Cash Income Percentile | |

| 2022 | |

Retirement Savings Incentives (Present Value Method)