The voices of Tax Policy Center's researchers and staff

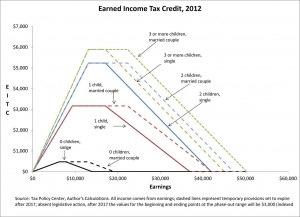

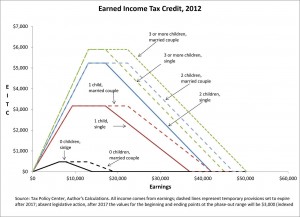

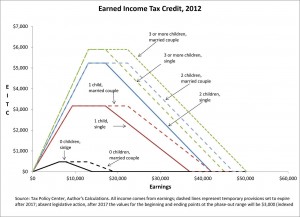

As tax filing season approaches, the IRS is reminding low-income families about the Earned Income Tax Credit (EITC). The EITC provides a wage subsidy for low- and moderate-income families and is an important income support for many. In 2012, a family with two children could receive an income boost of 40 cents for every dollar earned, until they reached the maximum credit of $5,236 (which happens once earnings reach $13,090). The credit begins to phase down when income exceeds $17,090 ($22,300 if married) and disappears entirely for families with two children when income hits $41,952 ($47,162 if married). A smaller credit is available for smaller families and a larger credit is available for families with at least three children (see chart), but that larger credit is scheduled to expire after 2017.  The Tax Policy Center estimates that almost 36 percent of all EITC benefits for 2012 will go to families in the lowest fifth of all incomes, and an additional 51 percent will go to families in the second income quintile. Almost no benefits flow to families in the top 40 percent of the income distribution. Because incomes at the bottom end of the distribution are highly volatile, EITC receipt status is often temporary with families typically receiving the credit for only one or two years. Research consistently finds that the EITC encourages work, especially among single moms. One study found that the EITC lifted over 6 million people out of poverty in 2009. The credit also improves infant health. In 2012, 24 states and the District of Columbia have an EITC which supplements the federal EITC by as much as 45 percent. It is not known how many people are eligible for the EITC and fail to claim it, though widely accepted estimates based on the 1990 tax year suggest between 16 and 20 percent of eligible families fail to claim the credit. Given the value of the credit, it is important to remind low-income families that it is a big reason why they should file a tax return. Kudos to the IRS for today’s EITC Awareness Day, which serves as an important reminder.

The Tax Policy Center estimates that almost 36 percent of all EITC benefits for 2012 will go to families in the lowest fifth of all incomes, and an additional 51 percent will go to families in the second income quintile. Almost no benefits flow to families in the top 40 percent of the income distribution. Because incomes at the bottom end of the distribution are highly volatile, EITC receipt status is often temporary with families typically receiving the credit for only one or two years. Research consistently finds that the EITC encourages work, especially among single moms. One study found that the EITC lifted over 6 million people out of poverty in 2009. The credit also improves infant health. In 2012, 24 states and the District of Columbia have an EITC which supplements the federal EITC by as much as 45 percent. It is not known how many people are eligible for the EITC and fail to claim it, though widely accepted estimates based on the 1990 tax year suggest between 16 and 20 percent of eligible families fail to claim the credit. Given the value of the credit, it is important to remind low-income families that it is a big reason why they should file a tax return. Kudos to the IRS for today’s EITC Awareness Day, which serves as an important reminder.

The Tax Policy Center estimates that almost 36 percent of all EITC benefits for 2012 will go to families in the lowest fifth of all incomes, and an additional 51 percent will go to families in the second income quintile. Almost no benefits flow to families in the top 40 percent of the income distribution. Because incomes at the bottom end of the distribution are highly volatile, EITC receipt status is often temporary with families typically receiving the credit for only one or two years. Research consistently finds that the EITC encourages work, especially among single moms. One study found that the EITC lifted over 6 million people out of poverty in 2009. The credit also improves infant health. In 2012, 24 states and the District of Columbia have an EITC which supplements the federal EITC by as much as 45 percent. It is not known how many people are eligible for the EITC and fail to claim it, though widely accepted estimates based on the 1990 tax year suggest between 16 and 20 percent of eligible families fail to claim the credit. Given the value of the credit, it is important to remind low-income families that it is a big reason why they should file a tax return. Kudos to the IRS for today’s EITC Awareness Day, which serves as an important reminder.

The Tax Policy Center estimates that almost 36 percent of all EITC benefits for 2012 will go to families in the lowest fifth of all incomes, and an additional 51 percent will go to families in the second income quintile. Almost no benefits flow to families in the top 40 percent of the income distribution. Because incomes at the bottom end of the distribution are highly volatile, EITC receipt status is often temporary with families typically receiving the credit for only one or two years. Research consistently finds that the EITC encourages work, especially among single moms. One study found that the EITC lifted over 6 million people out of poverty in 2009. The credit also improves infant health. In 2012, 24 states and the District of Columbia have an EITC which supplements the federal EITC by as much as 45 percent. It is not known how many people are eligible for the EITC and fail to claim it, though widely accepted estimates based on the 1990 tax year suggest between 16 and 20 percent of eligible families fail to claim the credit. Given the value of the credit, it is important to remind low-income families that it is a big reason why they should file a tax return. Kudos to the IRS for today’s EITC Awareness Day, which serves as an important reminder.

Posts and comments are solely the opinion of the author and not that of the Tax Policy Center, Urban Institute, or Brookings Institution.