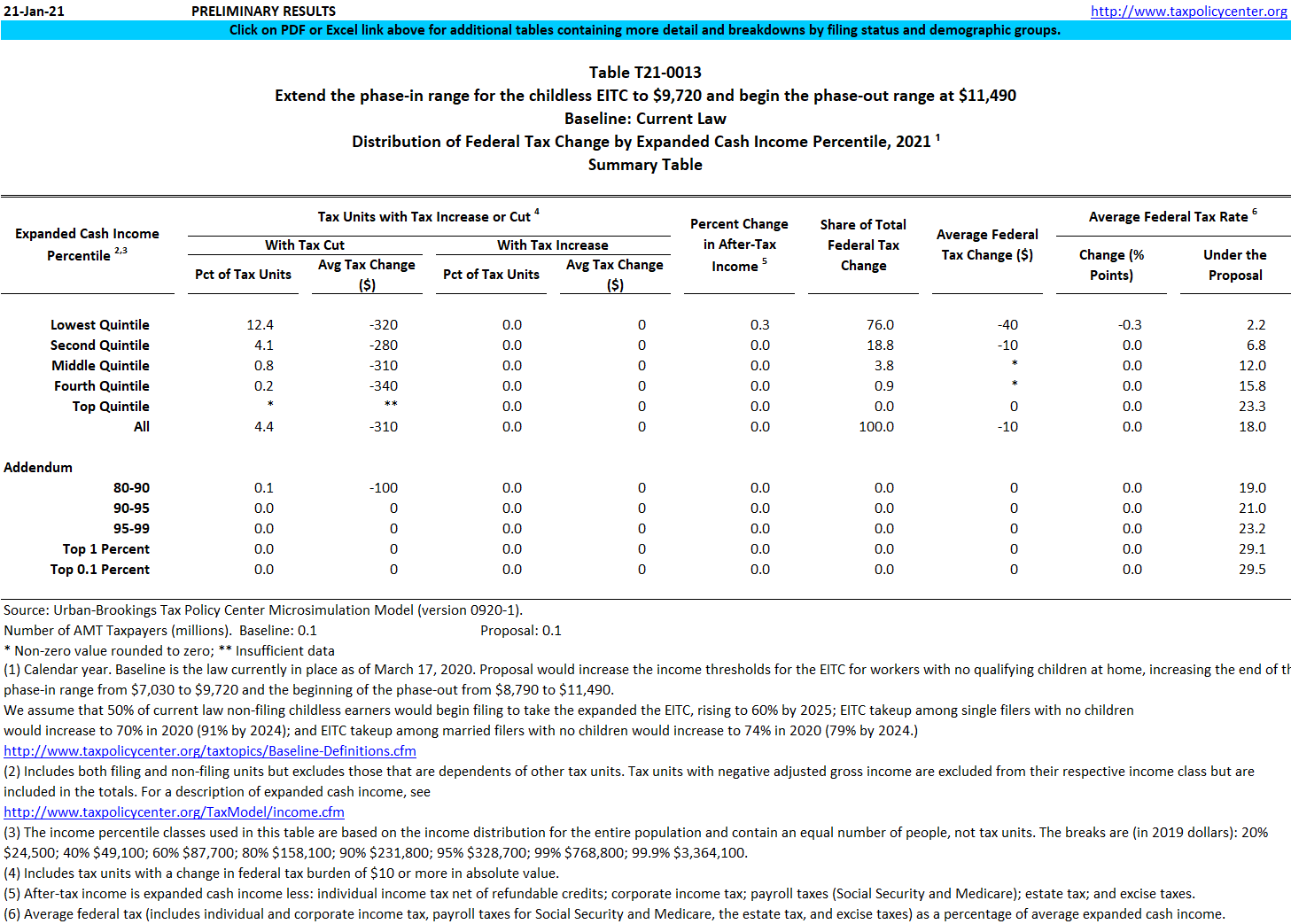

T21-0013 - Extend the phase-in range for the childless EITC to $9,720 and begin the phase-out range at $11,490; Baseline: Current Law; Distribution of Federal Tax Change by Expanded Cash Income Percentile, 2021

Distribution of tax benefits by expanded cash income percentile from extending the phase-in range for the EITC for workers who do not live with qualifying children to $9,720 and beginning the phase-out range at $11,490, 2021.